Income tax calculator for retired person

Total income tax -12312. Your 2021 Tax Return.

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

. For a single person making between 9325 and 37950 its 15. Reconcile Child Tax Credit Payments. Your household income location filing status and number of personal.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Instead we recommend you use the HMRC tax calculator to check youre being correctly taxed. Find Fresh Content Updated Daily For Tax on pension income calculator. New York state tax 3925.

This calculator only provides you with an indication of the tax you may have to pay based on rates and allowances which apply to the 202223 tax year. Special taxation arrangements apply to people aged 65 and over. For instance a person who makes 50000 a year would put away anywhere.

Tax Exemption for Senior Citizen Super Senior Citizens Check Income Tax Slab Rates Limit. Ad Enter Your Tax Information. Effective tax rate 172.

The calculator will calculate tax on your taxable income only. Taxation of social welfare payments. Your household income location filing status and number of personal.

A single person making between 0 and 9325 the tax rate is 10 of taxable income. Free step-by-step webinar September 19. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

This document is in. Age UK no longer provides a tax calculator. IR-2019-155 September 13 2019.

Income tax credits and reliefs. To better align with. This rule suggests that a person save 10 to 15 of their pre-tax income per year during their working years.

The tax implications of different tax-advantaged retirement accounts Social Security income and other sources of retirement income are all considered in our models. Married retirees filing jointly who earn less than 26450 if one spouse is 65 or older or who earn less than 27800 if both spouses are age 65 or older. Prepare federal and state income taxes online.

Estimate your US federal income tax for 2021 2020 2019 2018 2017 2016 2015 or 2014 using IRS formulas. E-File your tax return directly to the IRS. Enter your filing status income deductions and credits and we will estimate your total taxes.

Know All About Income Tax for Senior Citizens in India. WASHINGTON The new Tax Withholding Estimator launched last month on IRSgov. Effective tax rate 561.

Go to HMRC tax calculator. Tax information for seniors and retirees including typical sources of income in retirement and special tax rules. The good news is.

Marginal tax rate 633. When you received your Form W-2 Wage and Tax Statement prior to retirement you reported your wages on an individual income tax return such as Form 1040 US. See What Credits and Deductions Apply to You.

It takes into account income. Based on your projected tax withholding for the year we can also.

Planning For Retirement Using The Dave Ramsey Investment Calculator Dave Ramsey Investing Dave Ramsey Investing

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Taxtips Ca 2021 And 2022 Quebec Investment Income Tax Calculator

How I Retired At Age 30 With 500 000 Saved Personal Finance Advice Early Retirement Budget Advice

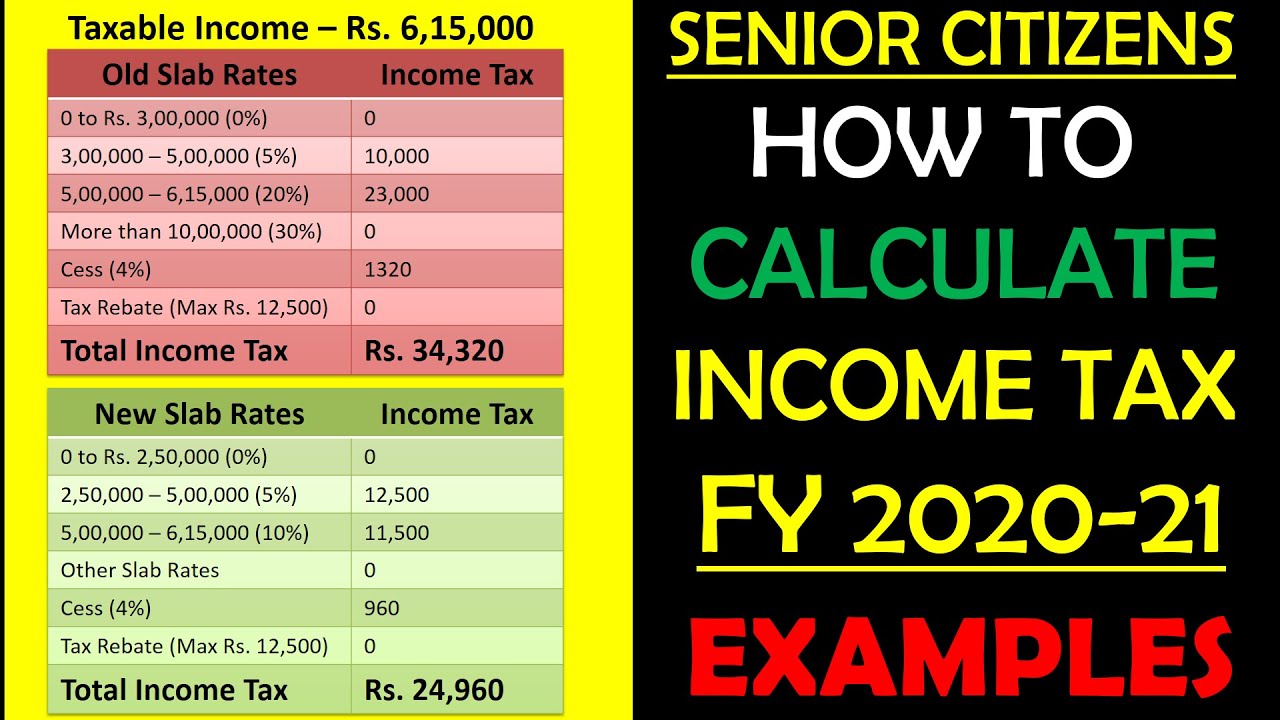

Income Tax Calculation Senior Citizens 2020 21 How To Calculate Income Tax Senior Citizens 2020 Youtube

Personal Income Tax Brackets Ontario 2021 Md Tax

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Ontario Income Tax Calculator Wowa Ca

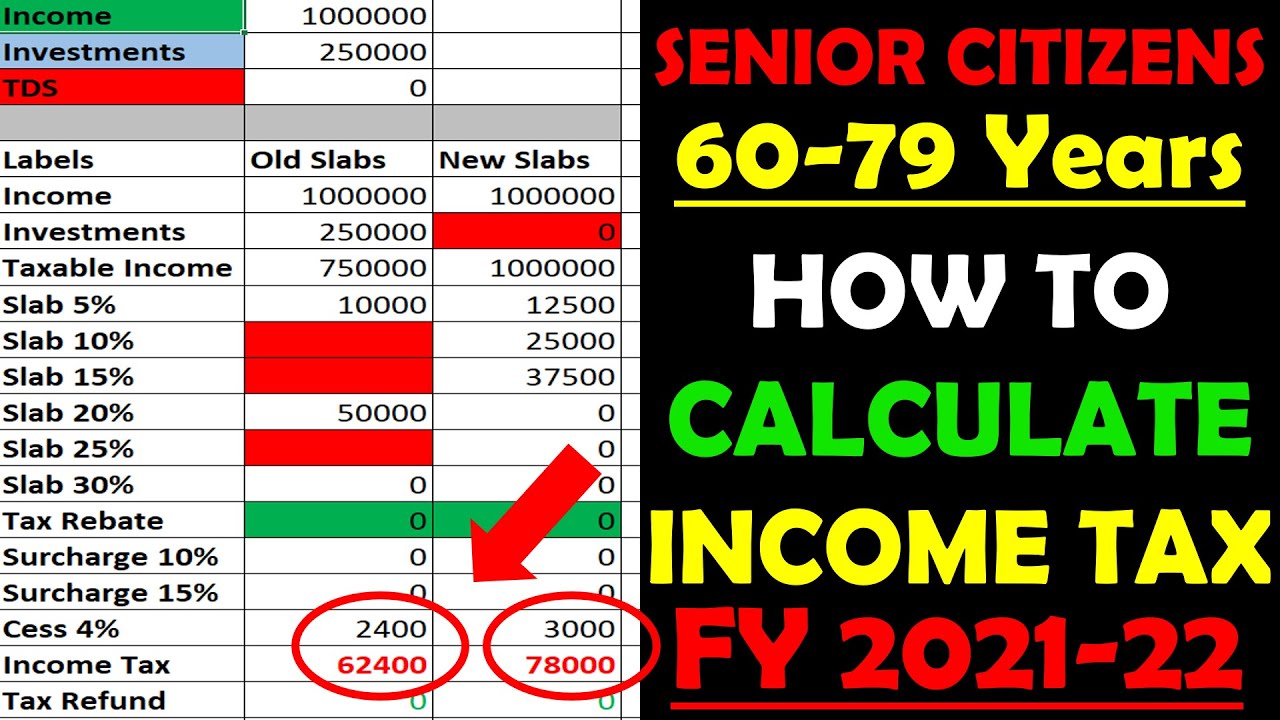

Senior Citizen Income Tax Calculation 2020 21 Excel Calculator Examples New Tax Slabs Tax Rebate Youtube

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator Examples New Tax Slabs Tax Rebate Youtube

Income Tax Excel Calculator Income Tax Calculation Fy 2020 21 Examples Youtube

2021 2022 Income Tax Calculator Canada Wowa Ca

Income Tax Calculation Senior Citizens 2020 21 How To Calculate Income Tax Senior Citizens 2020 Youtube

What Are Marriage Penalties And Bonuses Tax Policy Center

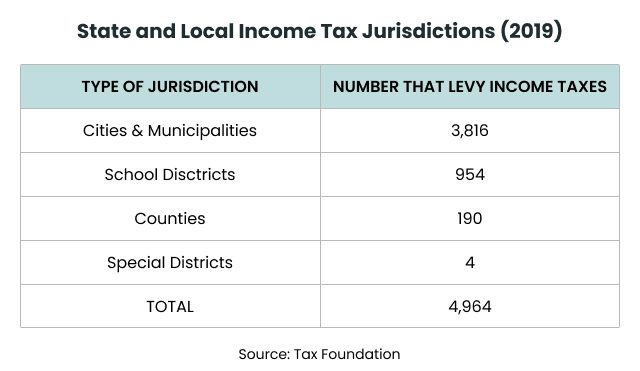

Income Tax Definition What Are Income Taxes How Do They Work